Asian Impact Management Review is an affiliate of Asian Institute for Impact Measurement and Management

The Role of Social Investing and How to Ensure Its Success

Summary: Social investing, merging financial returns with social impact, is growing rapidly. Fintech startups provide credible impact measurement tools, fostering transparency. However, greenwashing poses a challenge, necessitating comprehensive impact data.

Social investing, also commonly known as impact investing or purpose-driven finance, has certainly been drumming up a lot of interest for itself over the past few years. Investors around the world are making social investments to unleash the power of capital for good. As it makes its way to be a regular and perhaps uneasy feature within the circles of investment advisors and investor committees, we cannot ignore the fact that, globally, the sector has been expanding at its fastest pace. However, a key question always follows any media whirl ‘are enough investors being converted to social investing by the current buzz for this trend to continue, or do we still have some way to go in convincing the masses that the concept of social investing goes far beyond the current marketing hype that surrounds it?’

If we start at the basics, what do we mean by social/impact investing? The term was coined in 2007 by the Rockefeller Foundation and has been defined by GIIN (Global Impact Investing Network) as ‘investments made with the intention to generate positive, measurable social and environmental impact alongside a financial return’. At its core, social investments aim to provide capital to address the world’s most pressing issues, such as micro-finance, renewable energy, conservation, and access to affordable basic services, including housing, healthcare, and education.

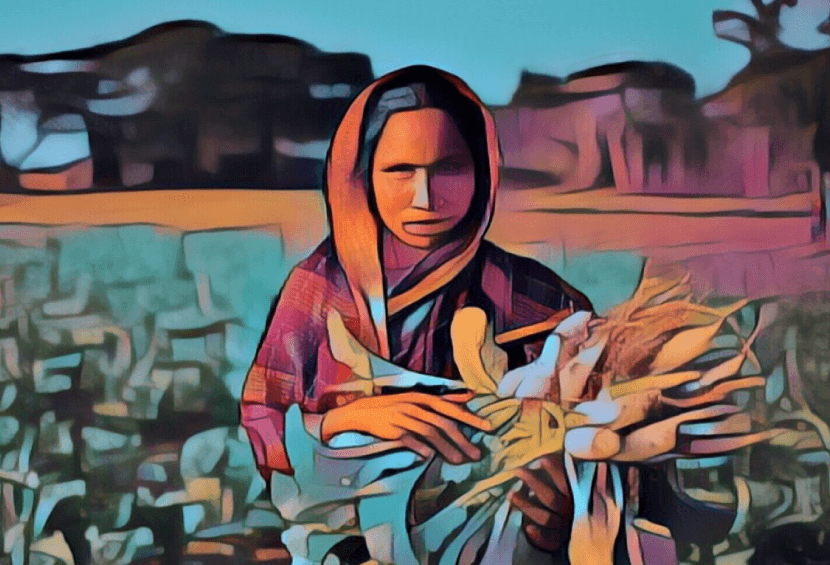

Source: GIIN, Understanding Impact Performance: Quality Jobs Investments, 2021

Figure exposition: We can see that the greatest proportion of investments (approx. 70%) in this sample was made in the sectors of food & agriculture, financial services (excluding microfinance; 20%), and microfinance (15%). These sectors directly relate to the SDGs of No Poverty (SDG1), Zero Hunger (SDG 2), Gender Equality (SDG 5), Decent Work and Economic Growth (SDG 8), and Reduced Inequalities (SDG 10), whilst having a cross-sectoral impact across all other SDGs.

Note: Percentages do not add up to 100% as a single investment can pertain to multiple sectors. Total of 478 investments were studied.

The case for becoming a global trend

Notably, these issues are not new but have historically fallen within the sphere of charitable donations and philanthropy, which have certainly gone a long way in tackling the aforementioned problems. However, significant gaps in financing still exist, and as we see a world being dominated by social unrest, climate change, and growing inequality, philanthropic capital can only go so far. Social investing offers a much-needed opportunity for investors to advance social and environmental solutions whilst still being financially profitable.

With an expected financial return on the investment, social capital can offer significant advantages over philanthropy. Primarily, social investing is more sustainable than philanthropic capital since the former goes towards supporting revenue-generating initiatives rather than programs that distribute funds until they run out. Hence, social investing brings with it the opportunity of providing repeated use of capital through re-investment of both the initial principle, as well as any profits that have been generated. Additionally, as this now becomes an investment opportunity rather than a charitable donation, it allows capital that was previously dedicated to only making money to be directed at addressing social and environmental challenges, casting a much wider net with regard to attracting resources to the sector. This is critical in addressing the UN Sustainable Development Goals (SDGs) financing gap.

We now have a pivotal opportunity for institutions and investors, who are increasingly seeking investments aligned with social objectives or the UN SDGs, to fill financing gaps and contribute to social development through their investments. The present market expansion of impact investments, which has seen a CAGR of almost 30% over the past three years1, is evidence of the exponential growth potential of the sustainable finance industry. With sustainable investing set to increase to 95% of global assets by 20302, and an expected wealth transfer of $68 trillion to the more socially conscious millennial generation over the coming years3, the investment appetite for creating positive change whilst being financially beneficial has never been higher.

Source: Morningstar data

Figure exposition: We can see from the chart the significant growth of the sustainable finance sector in recent years. By looking at net inflows to sustainability-themed funds from 2012 to 2021, we can see that growth in the sector has increased since Covid-19 – which highlighted key development areas such as financial security, public health, access to education, etc., as potential investment avenues for these funds.

Embedding impact measurement to drive sustainable development

However, challenges in catalyzing this momentum remain. In an era of increasing claims of greenwashing, a key question, and perhaps a barrier, that surrounds ESG and impact investments is ‘What difference is my investment actually making?’. There is an imperative need for better integration of sustainability and impact data to reflect the outcomes on beneficiaries and meet client expectations. The practice of impact measurement, where social and environmental outcomes are measured and tracked as part of the investment process, is a key enabler in bringing integrity to the sector and ensuring capital is reaching – and benefitting – target population segments.

A credible and robust impact measurement system, comprising the tools required to assess and report the impact of financing and investments, would provide institutions and investors the assurance that they are achieving their stated impact objectives and drive more catalytic capital towards achieving the development goals.

Fintech start-up GreenArc, which specialises in impact management, has become more attuned to the need for credible and transparent impact analysis to help institutions and investors understand the impact of investments to inform and facilitate more impactful decision-making. With their technology platform, impactGINI, GreenArc is helping to build a financial sector that drives the SDGs and serves social & environmental goals.

Source: UNCTAD, SSE database

Figure exposition: The rising stock exchange sustainability trends point to the increased levels of awareness and involvement of investors, shareholders, and companies on sustainability and ESG issues, as they strive to address the industry shift to attaining a more sustainable future.

How does it look in practice?

Taking a use-case in the market as an example, a global bank looking to evidence accountability for an impact investment they made into an Indonesian MFI portfolio was seeking transparent and credible impact measurement for stakeholder reporting. The investment’s impact objective was to reduce poverty, empower women and address income inequality by enabling their target population greater access to basic goods and services otherwise unavailable. As a data-driven platform, GreenArc’s solution leverages the benefits of technology, aligned with global industry standards, to provide impact scoring, analytics, and reporting. By identifying key impact metrics in alignment with stated impact objectives and collecting anonymized impact data directly from credit files, GreenArc was able to quantify the impact associated with the portfolio, accompanied by detailed analytics assessing the investment’s alignment with its stated impact objectives through a digital dashboard and impact report. For the first time, the Bank could see granular level information on how and where their investment was contributing towards greater impact and, perhaps more critically, identify how they could position portfolios and investments towards maximizing impact in the future.

Footnotes

1 GIIN – Global Impact Investing Network

2 Deutsche Bank estimates, Global Sustainable Investment Alliance (GSIA)

3 Forbes, 2019

To cite this article, please use:

Misra, M. (2023). The Role of Social Investing and How to Ensure Its Success. Asian Impact Management Review, Volume 2 (1), Summer 2023. http://doi.org/10.30186/AIMR.202307.0003

Comments (0)